This was fun to make. I did it for fun on my iPhone, and I used iMovie to edit. You can’t ever go wrong with Mozart either, although this style might match better with Rossini.

29 Deans Bridge Road in Somers is now $849,900. Someone is going to get a wonderful house at this price, and they will be glad they did. There is more information on the property here. It is a 3500 square foot Mediterranean with 3 bedrooms, 4 baths, and a lot with over an acre of land.

What Does $330,000 Buy in Patterson, NY?

You can still buy a nice 3 bedroom home in Putnam County for under $350,000 like the one our buyer client closed on last week. It is a fully renovated 1100 square foot 3 bedroom, 2 bath bungalow on a level lot with parking for at least 4 cars. The siding, roof, HVAC, walls, kitchen, and baths are all new. It is in the Putnam Lake community, so the property has lake rights- as a matter of fact the water is only about 500 feet from the front door. Putnam Lake (or “Put Lake,” as the locals and agents affectionately refer to it) is a woodsy, sleepy community of tidy homes that tend to be on the smaller side, so it is a great place for starter homes for anyone who likes lake living. There is shopping and food nearby, and the area is served by the Brewster school district.

You can still buy a nice 3 bedroom home in Putnam County for under $350,000 like the one our buyer client closed on last week. It is a fully renovated 1100 square foot 3 bedroom, 2 bath bungalow on a level lot with parking for at least 4 cars. The siding, roof, HVAC, walls, kitchen, and baths are all new. It is in the Putnam Lake community, so the property has lake rights- as a matter of fact the water is only about 500 feet from the front door. Putnam Lake (or “Put Lake,” as the locals and agents affectionately refer to it) is a woodsy, sleepy community of tidy homes that tend to be on the smaller side, so it is a great place for starter homes for anyone who likes lake living. There is shopping and food nearby, and the area is served by the Brewster school district.

The house is quite turnkey, and the rear yard is fenced off which is great for anyone who has pets. This one is gone, but my team can help you find one like it. Hit me up by call or text at 914-450-8883 and we will hook you up!

Here’s What $439,000 Buys in Highland, NY

I LOVE THIS HOUSE!

The dollar goes just a bit further in Ulster County than it does in Westchester, and this decked out cape that my clients closed on this week are ecstatic about their purchase. The prior owner did a marvelous renovation, and in addition to the wood burning fireplace and nearly an acre of level land, they will enjoy some wonderful modern upgrades.

It has a huge renovated eat-in kitchen, a formal dining area off the living room, 4 bedrooms, 3 baths, and some seriously awesome mechanicals: solar power, an ultra modern water filtration system, a backup generator, and ductless central air conditioning. It also offers a dynamite lifestyle, with a huge back yard that looks out at wilderness, a large patio, a turnaround driveway, and maintenance free siding. Just about everything is updated, from the septic system to the roof.

The team can help you find your own piece of paradise, all you need to do is call 914-450-8883 and we will see to it. We wish our clients many happy, healthy years in their new castle.

Bedroom Count and Septic Systems

Westchester County has a population of about 1 million residents. Most of those folks who inhabit the 914 area code live in homes that are connected to public sewers, but there are a hefty number of properties, especially in the northern part of the county, that are on septic systems. I’ve said before that there’s no practical difference between the two types of waste management for most people, in that you go, you flush, you live your life. But one aspect of properties on septic that is often misunderstood yet under discussed is the impact on bedroom count.

Westchester County has a population of about 1 million residents. Most of those folks who inhabit the 914 area code live in homes that are connected to public sewers, but there are a hefty number of properties, especially in the northern part of the county, that are on septic systems. I’ve said before that there’s no practical difference between the two types of waste management for most people, in that you go, you flush, you live your life. But one aspect of properties on septic that is often misunderstood yet under discussed is the impact on bedroom count.

In general, the number of legal bedrooms for homes on septic is not based on the number of rooms, but on the capacity of the septic system. I once had a listing with what appeared to be 4 bedrooms that was well over 3000 square feet that was considered a 2 bedroom home. We couldn’t call it a 4 bedroom because the septic system was a 2 bedroom septic. There’s a fantastic article on the official requirements here.

The reason for the bedroom count being tied to the septic capacity and not the actual room count is the presumed use for those living in the home. It stands to reason that a 2 bedroom home will have far fewer inhabitants-and therefore use far less water- than a 4 bedroom home.

I said all that to say this: If you have a home that presents itself like a 4 bedroom house but the official septic capacity is for 3 bedrooms, I cannot list it as a a 4 bedroom. You might have the thirstiest septic system in the county. You might have raised a family of 12 in the house with no issues whatsoever. It doesn’t matter. We have to list properties by their official characteristics. Even if I tried to fudge it and sell a 3 bedroom home as a 4 bedroom, the buyer’s due diligence would find the discrepancy and they could attempt to negotiate or, worse, get spooked about the misrepresentation and walk away. I could also be liable for an ethics grievance for not rendering a true picture of the facts on the home. It simply isn’t worth it.

What I can do is refer to the 4th room as a possible 4th quarters or say that the home lives like a 4 bedroom. But I cannot, in the official bedroom count, dissent from what the building department and certificate of occupancy say. The certificate of occupancy, or CO in the biz, should specify the bedroom count, and if it doesn’t, then the building department should have an official bedroom count. What your municipality says is the final authority.

Solving the Catch-22 on New Development: Build 55 and Over Housing

I posted not long ago that one of the reasons why inventory is so low is that we are not building new homes at a rate needed to meet our housing needs. It is estimated that we need another 7 million units to solve this, and that won’t happen overnight. What’s worse is that in many communities like my own home town of Ossining, NY, there is considerable resistance to new development. In reading local community group postings, online, the chief reason for opposing the construction of new housing is the strain it potentially adds on the traffic and schools. The Northeast as a whole does have older infrastructure, and not much wiggle room to widen roads and build new schools, and we already have the highest taxes in the universe.

I posted not long ago that one of the reasons why inventory is so low is that we are not building new homes at a rate needed to meet our housing needs. It is estimated that we need another 7 million units to solve this, and that won’t happen overnight. What’s worse is that in many communities like my own home town of Ossining, NY, there is considerable resistance to new development. In reading local community group postings, online, the chief reason for opposing the construction of new housing is the strain it potentially adds on the traffic and schools. The Northeast as a whole does have older infrastructure, and not much wiggle room to widen roads and build new schools, and we already have the highest taxes in the universe.

There is a proposal to build a new school, but the opposition to that will be significant. The last year a new school was built was around 1963, give or take. The population of the town was just over 26,000 according to the 1960 census. The current population stands at over 40,000 residents. Many of the existing schools have been expanded, but that’s been more of a bandage than a long term solution. Something does have to give; we can’t ignore the dwindling housing supply.

Looking back, I’m mindful of just how much times have changed. I recall as a youth in the 1970s that the district actually closed two schools due to the lower birth rate of the time, and new construction went from over 1000 new units in the 1960s to fewer than 250 in the 1970s. But the 1980s saw a resurgence in new development, mostly townhomes and condominiums, and eventually Roosevelt School, which had been closed and converted to offices in the early 70s, was reopened to accommodate the growing student body.

According to my search of public records, building declined in the 90s to 600 units, then mid 200s in the 2000s to only 31 from 2010-2019. That last one was probably due in large part to the Great Recession, but standing here in 2024 housing costs are nuts and any proposed new development always has vocal opposition.

Looking at the big picture of what is sustainable and works best in the long run, my vote would be to break ground on more 55 and over housing. The population is aging (I include my 56 year old self in that statement), and for many of us who are looking at empty nests and eventual retirement the options for downsizing are relatively sparse. There is a large population shift to the sunbelt and more affordable regions out of state, but that doesn’t do much for us locally. Denser townhome or condo style housing devoted to 55 and over should assuage the concerns about building. There would be far less strain on the schools, it broadens the tax base, and it gives more housing options to first time buyers when older folks transition to the new units. I certainly don’t think the commerce enjoyed from the new development would hurt either.

I don’t have a magic wand or housing emperor scepter, but if I did this would happen.

What Home Sellers Really Need to Know About the Commission Lawsuits

When I went to pick my son up from baseball practice earlier this week, a friend came up an smiled at me. “Sorry about your pay cut!” I knew what she was referring to, and as I peruse the news reports on the recent NAR commission settlement, I share many other Americans’ frustration at the failure of our journalism to accurately report on the matter. I know racy headlines get clicks and sell papers, but accuracy in reporting is still important.

When I went to pick my son up from baseball practice earlier this week, a friend came up an smiled at me. “Sorry about your pay cut!” I knew what she was referring to, and as I peruse the news reports on the recent NAR commission settlement, I share many other Americans’ frustration at the failure of our journalism to accurately report on the matter. I know racy headlines get clicks and sell papers, but accuracy in reporting is still important.

There are a few things that home sellers need to understand about what changes they can expect, and please understand that these are my opinions, and not the official stance of my brokerage.

- The settlement is still a proposal that still has to be approved by the courts. The wording and meaning of the verbiage may still change.

- While the (proposed) settlement may put a rest to the issue where NAR is concerned, almost 100 larger companies with enormous market share are not included. Moreover, Berkshire Hathaway has not settled and continues to litigate. If they prevail, that could change things dramatically.

- Contrary to the reports, commissions to brokerages aren’t going away, and may not even go down. What will occur is that the commission the seller pays to their listing agent will be unbundled from the buyer agent’s compensation. Since most buyers cannot pay a commission separately, they will elect to roll it into their proceeds of the sale, meaning the net to the seller will be structured virtually identically to how it is currently. We will just see more paperwork to get there.

- This is not a slam dunk win for consumers, especially buyers, under the current proposal. Most buyers, especially first time home buyers don’t have the funds to pay their commission out of pocket, and while many transactions can absorb the financing of the commission not unlike it is done now, the most vulnerable of buyers, namely VA (Veterans Administration) and FHA will not have the cash or equity to pay their agent. They will then face buying without an agent in the largest transaction of most of their lives, or figure out how to come up with extra cash.

- The proposed settlement will require buyers to sign an exclusive representation agreement with their buyer agent in order to tour homes and make offers. Now think about that sentence you just read. Every prospective buyer who just wants to check out a house is going to have to become contractually committed to their agent they use just to see the property. That contract will stipulate what the buyer brokerage will be paid in commission . That is a gift to the brokerage community, because we all prefer a consultation at the office first instead of meeting stranger alone in empty homes.

- Anyone who thinks that buyers will be fine just dealing with the listing agents don’t understand that they work for the seller’s best interests. Divided loyalty is not good for either party, and buyers dealing with a listing agent will not have an advocate, just a facilitator whose loyalty is to the seller client. Listing agents will not be eager (nor should they be) to have twice the work for the same commission either.

- Offers of compensation to buyer brokers will not go away. They will simply not be published in the MLS. I think it is still wise for sellers to offer buyer agent compensation, because it is misleading to think that the buyer broker will be able to collect their fee separately. That should still factor into the seller’s math. Any seller that truly thinks their entire proceeds will be a smaller commission to one agent is ignoring the reality that most buyers don’t have the capital to pay their agent separately.

- This will not make housing costs go down. The only thing I have ever seen that causes declines in property values is a national financial collapse like the S and L crisis in the 80s and the sub prime bomb in 2008 that caused the Great Recession. Housing is subject to the same economic forces as any other asset, such as the law of supply and demand. Right now, we are millions of housing units short of what we need. Short supply means high prices.

- Commission costs in total will likely not go down either. Making compulsory buyer brokerage contracts the law will give agents a silver platter showcase of their value proposition, and most consumers know that it is folly to make a home purchase a do it yourself project. Good buyer brokers will flourish in this environment, and mediocre ones will leave the industry. That’s good for consumers, and not good for lousy agents. But I can’t see commissions going down in total.

- The law of Unintended Consequences will make the journalism on this embarrassing for the media. I’ve already explained that property values and overall commissions will not decrease, but also that cash poor buyers will take it on the chin with this. If it harms the most vulnerable, first time homebuyers who are the backbone of the industry, then I don’t see a win for those consumers.

To sum up, home sellers should not expect some great savings here. The lawyers who are spiking the football over their “win” are the only clear winners here in my view. Savvy buyers will not stop the decades old practice of having their own representation in the largest transaction of their lives, and the best professionals will not work for less in any industry, including real estate.

This will separate the wheat from the chaff as less effective agents leave the industry and the scores of side gig, part time agents will diminish dramatically. The consumers should expect that they’ll get more for their money. In that respect, we all win.

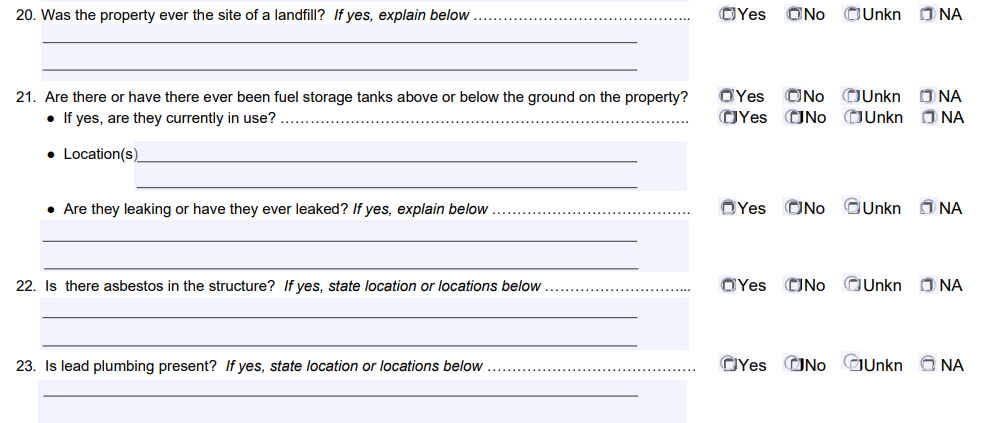

New York’s New Property Condition Disclosure Statement

For more than 20 years, home sellers in the state of New York have been required to furnish their buyer with a form known as a Property Condition Disclosure Statement (PCDS). It is a collection of several dozen questions that the seller is required to answer about the characteristics of the home. The law always allowed sellers to forgo the statement and credit their buyer $500 at closing instead, which is what sellers in this area did all the time. It was small price to pay for the theoretical shield of not making any representation that could be erroneous. As you can see, some questions are not easy to answer.

This is just a snippet from the 8 page, nearly 60 question form, but I can see why the advice was always to issue the $500 credit instead. Our housing stock around here trends older. How would someone know if there was ever a fuel tank on their property 100 years ago, or if there was ever a landfill there? The house I grew up in was on a former peach farm. That sounds harmless enough, but for all we knew there could have been a deep well, or a garbage pit, or a garage or fuel storage 100 years prior.

The law recently changed, and the following is the memo we got from our friends in Albany:

On September 22, 2023, Governor Hochul approved new legislation that provides significant

changes to the Real Property Condition Disclosure Statement (“PCDS”). The new law will go

into effect on March 20, 2024. This notice is intended to provide important information to real

estate licensees.

In advance of the change in law, the Department of State (the “Department”) has updated the

current PDCS, available on our website. Both the existing form and the future form will be

available until March 20, 2024. Real estate licensees are required to use the updated form, for all

transactions, starting on March 20th. Failure to use the correct form may result is liability to both

sellers and licensees. Accordingly, it is important to all parties to use the correct form starting

March 20, 2024.

In addition to new disclosure requirements, a key provision of the new law will be that sellers

may no longer forgo giving the PCDS in exchange for a $500 credit at closing.

The change has caused quite a stir, since there is no alternative to the statement anymore.

Here’s my advice to all home sellers:

Talk to your attorney.

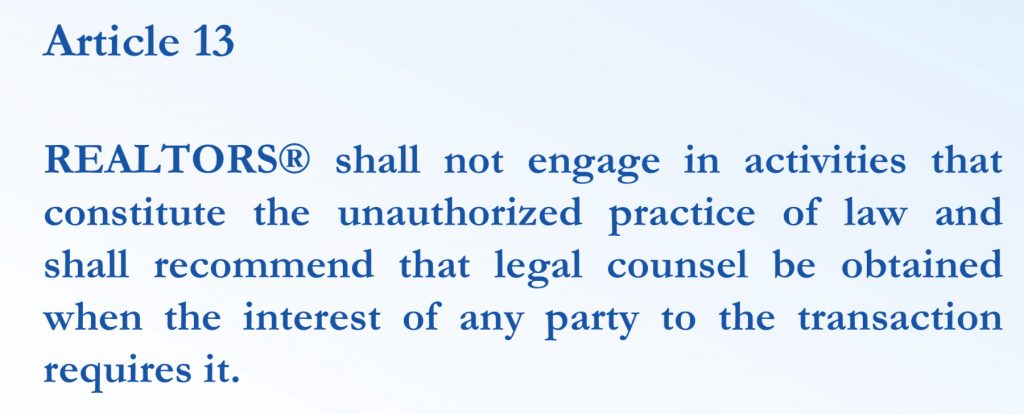

That’s it. That’s my advice. And if you think I’m being glib or passing the buck, let me explain that this is a recent change to a law that requires new paperwork, and the proper source for legal matters and related paperwork is…your attorney, not your broker. It is ethically prohibited for us to give legal advice.

Like any change, this is causing consternation and stress in the real estate industry, and like most changes the angst is worse than the reality. This form was filled out all the time upstate where $500 was not small change, and I’ve never heard of it causing any issue.

Bonnie Meadow Rd, AKA Dick Van Dyke Show Way

If you’re my age or older, you probably recall the the old Dick Van Dyke show. Dick Van Dyke Played Rob Petrie and his TV wife Laura was played by the great Mary Tyler Moore. You may not recall the exact address, but the Petrie family lived at fictitious 148 Bonnie Meadow Road, New Rochelle. Bonnie Meadow Road actually does exist! 9 out of 10 Westchester residents over the age of 50 know the show was set in New Roc, but even I didn’t know the address.

If you’re my age or older, you probably recall the the old Dick Van Dyke show. Dick Van Dyke Played Rob Petrie and his TV wife Laura was played by the great Mary Tyler Moore. You may not recall the exact address, but the Petrie family lived at fictitious 148 Bonnie Meadow Road, New Rochelle. Bonnie Meadow Road actually does exist! 9 out of 10 Westchester residents over the age of 50 know the show was set in New Roc, but even I didn’t know the address.

In my travels, I actually drove past Bonnie Meadow Road the other day, and I found out that it had been also named Dick Van Dyke show Way. This made me curious, so I did a little googling, and I found out that the local residents petitioned the city of Rochelle to rename the street for the iconic sitcom after Mary Tyler Moore passed away. The approval was around 2018.

That’s not all. Carl Reiner, the producer of the show (and father of Mike Reiner, who played Meathead on All in the Family) lived on 48 Bonnie Meadow Road back in the 1950s. He often stated that the show was based on many of his experiences living in suburban Rochelle at that time.

As I drove down the street, it was very clear to me that the on the set of show was obviously based on split branches that still exist on the street today.

Art imitates life!

What’s Up With All Those “We Will Pay You Cash for Your House” Signs on Street Corners?

If you’ve ever wondered what the story is behind those flimsy looking signs nailed to telephone poles all over the place promising you a fast cash sale on your house, I have the answer.

If you’ve ever wondered what the story is behind those flimsy looking signs nailed to telephone poles all over the place promising you a fast cash sale on your house, I have the answer.

I’m sure you know the signs I speak of. They are known in the industry as “bandit signs.” Some are professionally printed, others look like they were hand written with an oversized marker. They are meant to get attention, and they do work. It does seem strange, however, that someone with the means to write you a check for your house would be running around planting these signs on road sides and nailing them to poles. Decidedly not glamorous.

The people who have them posted are typically known as “wholesalers,” and they are more like middle men than the end buyer. The business model is to make the home seller an offer for less than market value, and then assign the contract to a real investor for a markup, which is where the wholesaler makes their profit.

For example, let’s say you are in financial difficulty or facing foreclosure and you see the sign at a red light. You call, and the “investor” comes to take a look at the property. Let’s pre-suppose that your home is worth $500,000 “as is” and maybe $580,000 with some renovations, like new bathrooms and a kitchen. The wholesaler makes you an offer for $375,000 with a fast, “as is” close, and then they work on assigning the contract to an investor, but the investor is quoted $385,000. That $10,000 is how the wholesaler makes their money.

How do I know this? I’ve met many of the wholesalers in this market. I called a few of them, but most of the time they call me, because we have an investment group that buys houses.

The practice is legal for non-licensees but as an agent I would not engage in it. The wholesaling model is no different than buying something at a thrift shop and selling it for a profit on eBay. “Buy low, sell high” is not a new idea. If you ask me if the people who engage in the model are advisable to deal with, my answer would be that it depends. Some of them are fine. Some of them are slimy. I’ve been exposed to both. There is a concern voiced by some that there is potential for abuse here- an elderly person who might have no reason to sell for less than market value might think that $375,000 is awesome because they bought the place 50 years ago for $65,000. I would agree that such an arrangement is exploitation.

Why don’t I do it? The model is dangerously close to selling what’s called a “net listing” in New York, which is prohibited for licensees. But if the question is more broad, like would I offer that little old lady $375,000, my answer would be no. But that’s a far deeper dive for another post. But for today, now you know what those bandit signs are all about.

What $705,000 Will Buy You in Ossining

If your budget is in the $700,000 range and you’re looking in Ossining, you’ll be pleased to know that you can still buy a 4 bedroom home on over an acre like the one we just closed on this week in town. 5 Ridgeview drive has 4 bedrooms, 3 baths, and a 1.6 acre lot.

If your budget is in the $700,000 range and you’re looking in Ossining, you’ll be pleased to know that you can still buy a 4 bedroom home on over an acre like the one we just closed on this week in town. 5 Ridgeview drive has 4 bedrooms, 3 baths, and a 1.6 acre lot.

The MLS description:

Sprawling ranch on a level acre plus and cul de sac road near all local amenities! Brand new driveway, impeccable landscaping, and delightful curb appeal. Large flat yard with over an acre of a half of room for all you desire outside! first time to market in over 70 years after contactor owner has lovingly maintained the domicile. T shaped layout with 3 bedrooms inclusive of master bedroom/bath, formal dining room, and bright living room with a wood burning stove in the fireplace and bay windows showcasing the stunning private patio. The short hallway to the back rooms with floor to ceiling windows viewing the patio and yard, 4th bedroom with a second master bath en-suite, and family room with lots of windows and sliders to the rear deck overlooking the back yard and wooded bliss. The full basement offers more opportunity for a rec area, home office, storage, or whatever else your heart desires. A stunning home at an unbeatable price point.

Indicative of the market, the home had an accepted offer after 8 days. The sellers were wonderful clients and we wish them the very best going forward. This one is gone, but we have more. Contact me at (914) 450-8883 and my team can help you find your dream home.

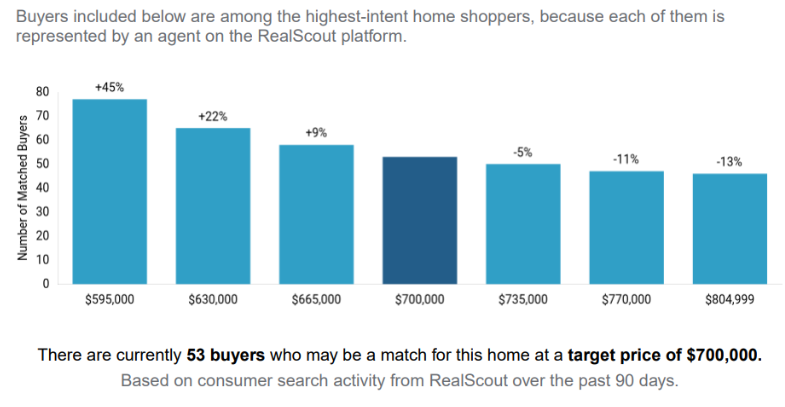

Price Changes Are No Longer Guesswork

When I was first licensed in the 1990s, if a house didn’t sell for a period of time like 30 or 60 days, we would often reduce the price. Sometimes it was because we had too few showings, or because the showings we had didn’t yield any offers. On occasion, some home sellers would voice concern at a price change because no one had seen the house to give them price feedback. We’d have to explain that the feedback was the actual absence of showings. It wasn’t a truly data-driven process, however, because we had no means of measuring who saw the house either through their agent’s analog means (like seeing it in a broker’s binder) or advertised in publications and passed on it. We did have ample evidence that once a price was reduced, that the market responded.

When I was first licensed in the 1990s, if a house didn’t sell for a period of time like 30 or 60 days, we would often reduce the price. Sometimes it was because we had too few showings, or because the showings we had didn’t yield any offers. On occasion, some home sellers would voice concern at a price change because no one had seen the house to give them price feedback. We’d have to explain that the feedback was the actual absence of showings. It wasn’t a truly data-driven process, however, because we had no means of measuring who saw the house either through their agent’s analog means (like seeing it in a broker’s binder) or advertised in publications and passed on it. We did have ample evidence that once a price was reduced, that the market responded.

It’s very different today. We have a number of digital means of measuring the interest -or lack of it- in a listing based on online metrics.

A few examples:

- Web traffic. We have access to dozens of websites that can inform us how many people have viewed the property, saved it, and if they viewed it multiple times. Zillow, Trulia, Realtor.com, our own website, and our client platforms all have some form of revealing the listing’s performance.

- Saved or Bookmarked listings. The same online assets can also tell us how many people added a listing to their favorite or saved list.

- Proprietary client portals stats. Often when a buyer client is working with an agent, that agent’s brokerage has an online client platform (ours is called RealScout) that tells us when a particular listing is opened or saved. This is not like raw web traffic. These are active clients who have a representation contract with an agency and have a login to a concierge type site that gives us rich data on a listing’s performance.

- Predictive analytics. This is crazy stuff. The program uses big data and is enhanced by AI, and can give us a far deeper dive into activity around a listing, and also tells us how many registered clients would likely save or match up with a listing by an algorithm fueled by web behavior. Simply put, it will tell me that a listing will garner 40 interested parties at $840,000 but 65 interested parties at $799,000. This is extremely data-driven and granular.

- Reverse prospecting. This is in the back office of the MLS and gives a listing agent a list of every instance where a fellow MLS member has sent this listing to a client.

Given that with virtual tours, floor plans, high resolution photos and even drone imaging every listing is virtually an open house online 24/7, we can therefore see if the listing’s performance is in sync with the online metrics, or if a price reduction is in order. Let’s take, for example, two similar listings with comparable characteristics; one is priced at $699,000, the other at $729,000. The 699 home has 500 unique views, 25 favorites, 20 showings the first two weeks, 35 reverse prospecting matches, and 2 offers. The 729 house has 350 unique views, 3 favorites, 8 showings the first 2 weeks, 15 reverse prospecting matches, and one offer below asking. It doesn’t take much to conclude that $729,000, even in this market, is too high.

If a home is under performing on the market, the seller should ask their agent to see the data on the home’s online metrics with consumers. The agent should be able to compare their performance with a comparable property, and even use the predictive model to see what would change with a price improvement. The math defines the path- armed with data, the agent and client should be able to know what the best move should be for pricing.

Upon occasion, we are asked by the seller if the perception of the public will change with a price drop. The concern is that the seller might appear desperate or something like that. Soon, I will write a piece on the things we overthink in this industry. That question will be prominent. In this market, those fears evaporate when the buyer competition heats up with a correctly priced listing.

How Online Reviews Have Impacted Real Estate Agents

Back in 2009, I was approached by Redfin to help them enter the Westchester real estate market as a referral partner. They did not have employee agents here, so referring clientele to other brokerages would be a win/win arrangement to start. I was eager for any new source of business, and took a closer look. Part of their vetting process was to survey my past clients, which was fine, but to also publish my client’s reviews online.

Back in 2009, I was approached by Redfin to help them enter the Westchester real estate market as a referral partner. They did not have employee agents here, so referring clientele to other brokerages would be a win/win arrangement to start. I was eager for any new source of business, and took a closer look. Part of their vetting process was to survey my past clients, which was fine, but to also publish my client’s reviews online.

My reviews were very nice, which was gratifying, and for the few years I acted as a Redfin referral partner agent I compiled more good ratings. It was all within their ecosystem, and while it was a tiny bit nerve wracking to wait for the responses, they were all positive.

Enter Zillow.

In late 2010, Zillow announced their own agent review platform, and it was different. Unlike Redfin, which surveyed their own clients’ transactions, Zillow’s reviews would be open to anyone. This concerned me. I wrote in the linked post a worry that the integrity of the reviews could be compromised by competitors and people gaming the system with bogus reviews, among other things.

Well, Zillow did the right thing and ensured that controls would be in place to prevent fraud. And here we are 13 years later and agent reviews are ubiquitous- Zillow, Google my Business, Facebook, and Yelp, to name the most recognizable names. These days we train our agents to get as many reviews as possible. How far we’ve come from the time when 20 reviews was considered a high amount, and my Zillow profile just got my 400th review.

The public now expects reviews for agent just as they do on Amazon products, Uber drivers, or restaurants. Looking back, I think the angst was more about the pain of change than worries that we’d get bad reviews. Real estate is a funny business- anytime transparency is introduced, the address, price or marketing history, and these days the agent commission, people worry that we’ll lose our value proposition. But we’ve never been good gate keepers, and more people use agents to represent them than before the Internet became prominent. The truth has never been our enemy.

Living Indoors is Not a Fad

In some respects, the housing market is like the biggest, longest domino set up in the universe. Chances are, with rare exception like the purchase of an empty house, that the person you are buying your home from is going to be moving somewhere that someone else moved out of, and they in turn are going to move somewhere where someone else is moving from, and so on ad infinitum.

Part of our job as agents as a matter of fact, is coordinating the move out and move in for clients, and it can get a little complex. But the bottom line is when someone does move out of a residential domicile, they are moving into another residential domicile.

Not an igloo.

Not a nomadic wagon caravan.

Not a houseboat.

Not a teepee or wigwam.

And no, they do not begin a new life as an avid camper.

So it amuses me when another agent is taken by surprise that the logistics of my clients relocation might have an affect on their client’s plans. We as agents don’t set closing dates in New York- that is left to the attorneys, lenders and title companies. But I have to have these discussions with my counterpart agents nonetheless. It’s like setting up a lunch date with an old friend.

How’s next Monday?

Oh, Mondays are bad, what does Tuesday look like?

Tuesday is fine with me.

Great! Tuesday it is.

This is not rocket science. But sometimes we make it harder than it has to be.

This text exchange is an example of what I’m talking about. The other agent sent me a text stating that we should be closing in January, to which I replied that we are not, because my clients would not be moving until February. Somehow this caught them offguard.

Bless this agent’s heart. As I’ve said before, it is difficult to explain these things without sounding sarcastic. My clients had a choice: rent their next home or buy something. They chose to rent for the time being. Renting is far less involved than buying, so I’m unclear as to why the fact that they are renting was such a curveball.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Decades ago when I was tending bar, we always knew to avoid any discussion of politics or religion because it was a powder keg. In real estate, that would also include any discussion involving Zillow, dual agency, and square footage.

Decades ago when I was tending bar, we always knew to avoid any discussion of politics or religion because it was a powder keg. In real estate, that would also include any discussion involving Zillow, dual agency, and square footage.

The term “in law apartment” or “in-law space” has become misunderstood lately by both agents and consumers, so I’d like to clear up what should be fairly straightforward.

The term “in law apartment” or “in-law space” has become misunderstood lately by both agents and consumers, so I’d like to clear up what should be fairly straightforward.

If I were asked by a seller what separates me from other agents to get them the best price for their home, I’d answer their question with a question of my own.

If I were asked by a seller what separates me from other agents to get them the best price for their home, I’d answer their question with a question of my own.

Ever since I got in to real estate in the 90s, the public has had a bit of a preoccupation with buying foreclosures. The perception that a bank owned property is a bargain is hard to argue with, but it’s not always a simple or straightforward process. Having specialized in distressed properties for decades, I’ll share some things that buyers really need to know before they purchase something around these parts, because New York is a different animal, and Westchester and the surrounding counties are not like upstate either.

Ever since I got in to real estate in the 90s, the public has had a bit of a preoccupation with buying foreclosures. The perception that a bank owned property is a bargain is hard to argue with, but it’s not always a simple or straightforward process. Having specialized in distressed properties for decades, I’ll share some things that buyers really need to know before they purchase something around these parts, because New York is a different animal, and Westchester and the surrounding counties are not like upstate either.

Swimming pools are probably the last thing on most peoples’ minds but we are still selling homes that have them, and this thought is a bit overdue.

Swimming pools are probably the last thing on most peoples’ minds but we are still selling homes that have them, and this thought is a bit overdue.

Escalation Clauses in Offers to Purchase: a Double Edge Sword

The first escalation offer I can recall was a sale I made in 2012. The house was a rare offering and the market was, at long last, recovering, and the winning bid promised to be $2500 higher than any superior offer. The listing was sold for about $40,000 over asking, and that clause made the difference for the buyer who ended up getting the house. That buyer was paying cash, so it was a particularly strong proposal in the terms category as well as price.

When the market heated up around 2020, escalation clauses became far more common. Not many listing agents understood them well enough to properly convey the message to their seller clients as effectively as they could have, but by 2021 most agents grasped the mechanics.

Unfortunately, some agents know them a little too well. Yes, escalation clauses are no longer viewed as obscure or a gimmick, but they aren’t always the answer. Here are a few scenarios where they just don’t work the way the presenting agent thinks they will:

It has gotten to the point where some listings will state that no escalations will be entertained. We recently had a multiple offer situation on a listing where the winning bid was chosen because it had a high down payment and waived the appraisal contingency. An offer with a VA mortgage came in with an escalation clause, but VA mortgages are 100% financing, or 0 down. That might have gotten the seller an additional $5,000, but the risk of going to contract with a buyer with no cash to cover an under appraisal was not palatable for the seller. The buyer agent was unhappy about this, and I do appreciate the uphill battle VA buyers face, but that agent did not have an answer for the possibility of an appraisal problem.

Escalations can indeed make a difference. But they aren’t the panacea that some think they are because of the law of unintended consequences connected to other terms, and agents need to educate their clients that the clause isn’t a magic wand.