The conventional wisdom for people with a house they own who want to buy a new home has always been that they sell their current home before they made an offer on a new home because no seller wants a “contingent” deal on their sale. Also known as a Hubbard Clause or a sales contingency, it has always posed a risk for a seller because their sale depends on their buyer finding a buyer of their own. As a listing agent I’ve even had newer agents tell me that once my seller client agrees, their buyer will list their home for sale. Since it’s always been easier to buy than to sell, that seldom worked out.

The conventional wisdom for people with a house they own who want to buy a new home has always been that they sell their current home before they made an offer on a new home because no seller wants a “contingent” deal on their sale. Also known as a Hubbard Clause or a sales contingency, it has always posed a risk for a seller because their sale depends on their buyer finding a buyer of their own. As a listing agent I’ve even had newer agents tell me that once my seller client agrees, their buyer will list their home for sale. Since it’s always been easier to buy than to sell, that seldom worked out.

Times have changed. Many people who might otherwise want to sell don’t, because they have no idea where they will go once they get a buyer for their home. This is common because inventory is so cartoonishly low. Therefore, they want to find something before selling their current home. Given that we are in a strong seller’s market, many sellers are now Ok with this. But the challenge is often that the buyer’s money is tied up in their current home’s equity, and they cannot always even make the earnest money deposit required to secure their purchase.

The solution in some cases is to secure a bridge loan, but that isn’t always a simple or easy process as some clients of mine recently discovered. I’m pleased to share that Howard Hanna and their subsidiary 1st Priority Mortgage have the solution, the Buy Before You Sell program. It allows people to start the purchase of the home they want while it’s still available by tapping into their current home’s equity with a 90 day deferred interest bridge loan.

Here are a few more key points I’ve been furnished with by my colleagues about the Howard Hanna Rand version of the Buy Before You Sell program for Westchester, Putnam and surrounding counties:

- Allows the buyer to take Advantage the equity in your current home, now rather than later

- Specialized tool for our family – Existing property must be listed with you and will use you to purchase their new home plus use 1st Priority for their mortgage

- Property needs to be in a licensed state

- Out of pocket expense less than $400 at time of application; appraisal and credit report

- Drive by appraisal only on current home

- Low rate of 8% and payment is interest only

- Max Term 1year

- Payments deferred for 1st 90 days (interest accumulates)

- If loan closes within the first 90 days, we will issue a payoff statement for principal amount along with per diem amount of interest

- Existing home to be listed prior to closing with a Howard Hanna agent

Those terms and small print are pretty reasonable and simple. This is for Howard Hanna clients whose home is listed with one of our brands (locally Howard Hanna Rand in Westchester and Hudson Valley or Howard Hanna Coach out on Long Island) and is through 1st Priority Mortgage. I’m a fan of this program; so many people out there would love to sell, but they simply don’t know where they can go! Since moving is a big enough project to begin with, a short term rental or just uncertainty of the next destination or not viable options. This takes the uncertainty out of the equation.

The loan officers who I’ve worked with at 1st Priority are industry veterans whom I have known and respected as professionals for many years. It’s always a pleasure to work with them and my clients have always been in good hands. They also do a great job at keeping our agents informed on the mortgage market, which is incredibly helpful.

If you are thinking of selling but concerned that you aren’t sure where you’ll go, this is a program worth looking into. Call me at 914.450.8883 and I can walk you through it.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

In 1962, my older brother Paul, then just 4 years old, got gravely ill and was rushed to the hospital.

In 1962, my older brother Paul, then just 4 years old, got gravely ill and was rushed to the hospital. In 2015 I was asked to attend a hearing at the Town Hall of New Castle, NY to hear local residents speak on the expansion of a local children’s hospital, the Sunshine Home. I expected formalities. The expansion of a children’s hospital didn’t strike me as something anyone would oppose.

In 2015 I was asked to attend a hearing at the Town Hall of New Castle, NY to hear local residents speak on the expansion of a local children’s hospital, the Sunshine Home. I expected formalities. The expansion of a children’s hospital didn’t strike me as something anyone would oppose. This past week I was contacted by the Sunshine administration and invited to take a tour of the nearly completed expansion. I was able to walk through with the director and got a tour of the magnificent job they did. In addition to increasing the bed count from about 50 to over 120, the resources available to the patients and their families are so extensive and first class that even my big mouth can hardly do it justice. The physical plant itself doesn’t feel like a hospital. It is a bright, airy, colorful lodge.

This past week I was contacted by the Sunshine administration and invited to take a tour of the nearly completed expansion. I was able to walk through with the director and got a tour of the magnificent job they did. In addition to increasing the bed count from about 50 to over 120, the resources available to the patients and their families are so extensive and first class that even my big mouth can hardly do it justice. The physical plant itself doesn’t feel like a hospital. It is a bright, airy, colorful lodge. Willy Wonka than the expected utilitarian feel of a hospital. The utility is still there- it’s the presentation, however, that makes such a huge difference.

Willy Wonka than the expected utilitarian feel of a hospital. The utility is still there- it’s the presentation, however, that makes such a huge difference.

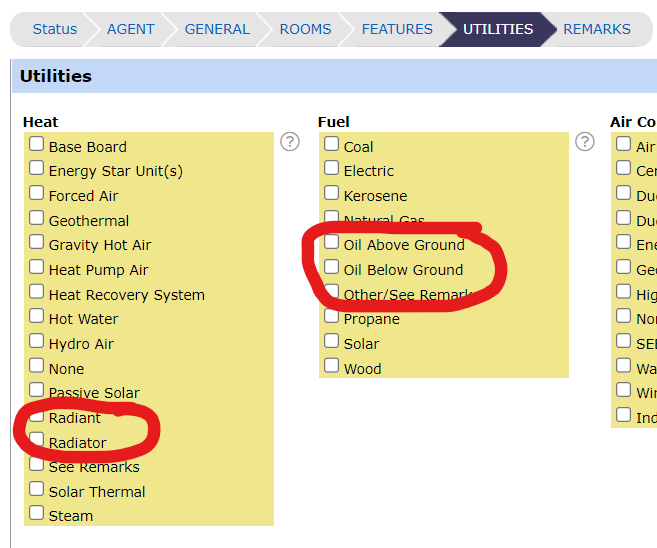

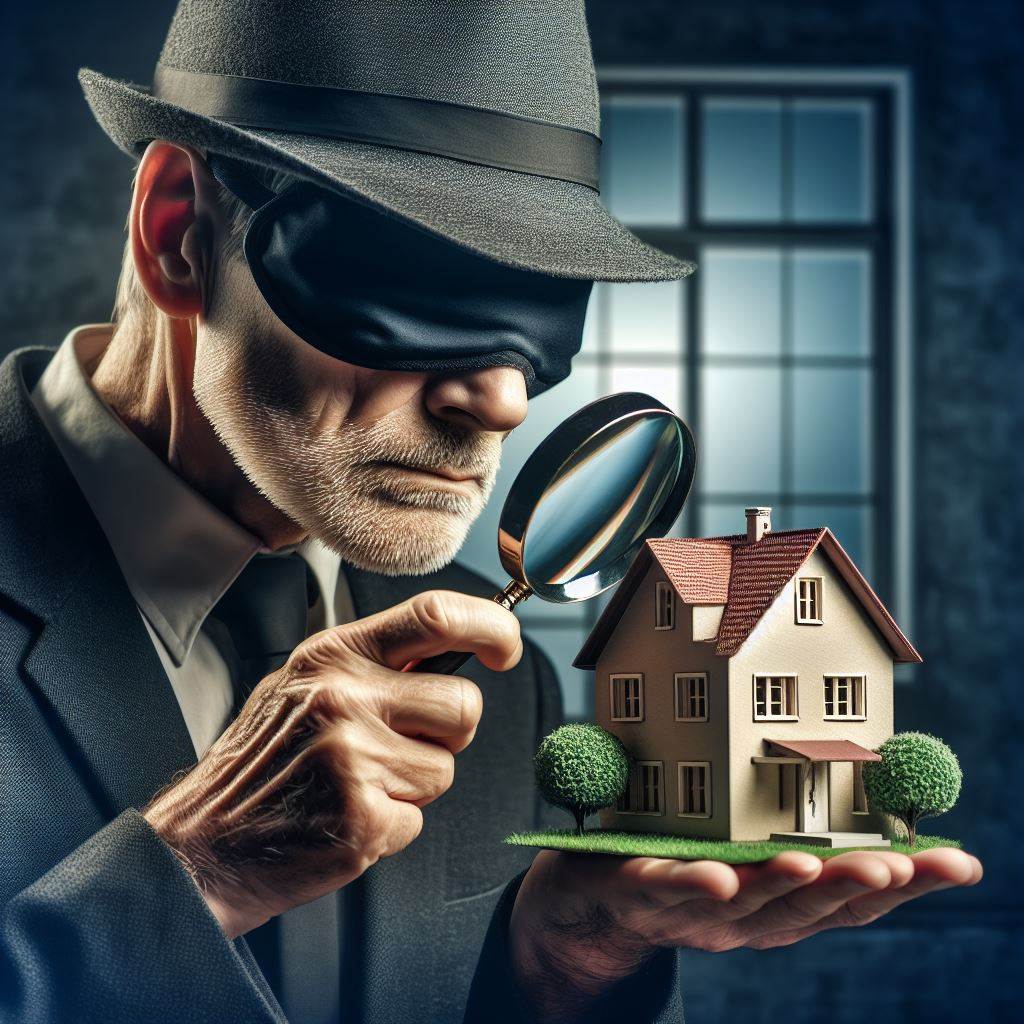

Buyers don’t need a buyer agent simply because they can open a lockbox and facilitate an offer. To do their job properly, buyer agents have an obligation to perform due diligence on the property they represent their buyers on, and sadly I’m not seeing that all too often. Buyers should expect that their agent will do verify a significant amount of information on behalf of their client:

Buyers don’t need a buyer agent simply because they can open a lockbox and facilitate an offer. To do their job properly, buyer agents have an obligation to perform due diligence on the property they represent their buyers on, and sadly I’m not seeing that all too often. Buyers should expect that their agent will do verify a significant amount of information on behalf of their client:

This was clearly being sold by someone who was into do it yourself projects on the property. There was ductwork for central air that was not utilized. There were split units on many walls, part of an extensive system that was hard to piece together for us. A separate flue had been added to the heating system that was unused. There were drainage grates on one side of the house with electrical wires going down into the drain itself. The basement workshop appeared to be an active one, with pipes, hoses, and registers and systems that appeared to be connected to the split units. Outside, electric cables were run alongside the house, partially enclosed with downspouts.

This was clearly being sold by someone who was into do it yourself projects on the property. There was ductwork for central air that was not utilized. There were split units on many walls, part of an extensive system that was hard to piece together for us. A separate flue had been added to the heating system that was unused. There were drainage grates on one side of the house with electrical wires going down into the drain itself. The basement workshop appeared to be an active one, with pipes, hoses, and registers and systems that appeared to be connected to the split units. Outside, electric cables were run alongside the house, partially enclosed with downspouts.

The following is a list of good reasons for a buyer to waive their home inspection:

The following is a list of good reasons for a buyer to waive their home inspection:

Years ago, I was the listing agent on a property where an offer came in significantly below asking price. The pre approval accompanying the offer was for the exact amount offered, tens of thousands of dollars below asking. My client asked why, if they were only approved for $450,000, that they’d even look at a home listed for $500,000.

Years ago, I was the listing agent on a property where an offer came in significantly below asking price. The pre approval accompanying the offer was for the exact amount offered, tens of thousands of dollars below asking. My client asked why, if they were only approved for $450,000, that they’d even look at a home listed for $500,000.

Recently, a client shared with me that a friend advised them to avoid homes on septic and to only buy a home with a public sewer connection.

Recently, a client shared with me that a friend advised them to avoid homes on septic and to only buy a home with a public sewer connection.

This past Sunday I covered for one of our agents and met up with some first time homebuyers for their very first home tour. We had a big day scheduled: 5 confirmed appointments, all of the homes looked good, and the clients were excited to get their dream home.

This past Sunday I covered for one of our agents and met up with some first time homebuyers for their very first home tour. We had a big day scheduled: 5 confirmed appointments, all of the homes looked good, and the clients were excited to get their dream home.

My last two posts have addressed the fact that despite the higher interest rates, it remains a seller’s market because of low inventory of listings. I wrote about why inventory is so low yesterday, and today I’m going to pretend I’m the HUD secretary and Housing Emperor (a position I made up but I’d love that job) to talk about how to get out of the corner the housing market has painted itself into.

My last two posts have addressed the fact that despite the higher interest rates, it remains a seller’s market because of low inventory of listings. I wrote about why inventory is so low yesterday, and today I’m going to pretend I’m the HUD secretary and Housing Emperor (a position I made up but I’d love that job) to talk about how to get out of the corner the housing market has painted itself into.

Yesterday I wrote about the low inventory and the challenges buyers face with supply not measuring up to demand. I did not address the reason why buyers have so little to choose from, and that’s what I’ll attempt to tackle.

Yesterday I wrote about the low inventory and the challenges buyers face with supply not measuring up to demand. I did not address the reason why buyers have so little to choose from, and that’s what I’ll attempt to tackle.

But we aren’t in a typical market here in Westchester and the surrounding areas, and we haven’t been since the Covid pandemic. Right now, the low inventory has resulted in a significant amount of pent up demand, and homes listed around the holidays are enjoying attention that makes it feel like spring despite the temperature. There are legions of prospective home buyers who didn’t have much luck in the spring or summer who are still looking in earnest.

But we aren’t in a typical market here in Westchester and the surrounding areas, and we haven’t been since the Covid pandemic. Right now, the low inventory has resulted in a significant amount of pent up demand, and homes listed around the holidays are enjoying attention that makes it feel like spring despite the temperature. There are legions of prospective home buyers who didn’t have much luck in the spring or summer who are still looking in earnest.

$449,000 will buy you a condominium with Hudson Views like the one I just closed on. The MLS description for the property are as follows:

$449,000 will buy you a condominium with Hudson Views like the one I just closed on. The MLS description for the property are as follows:

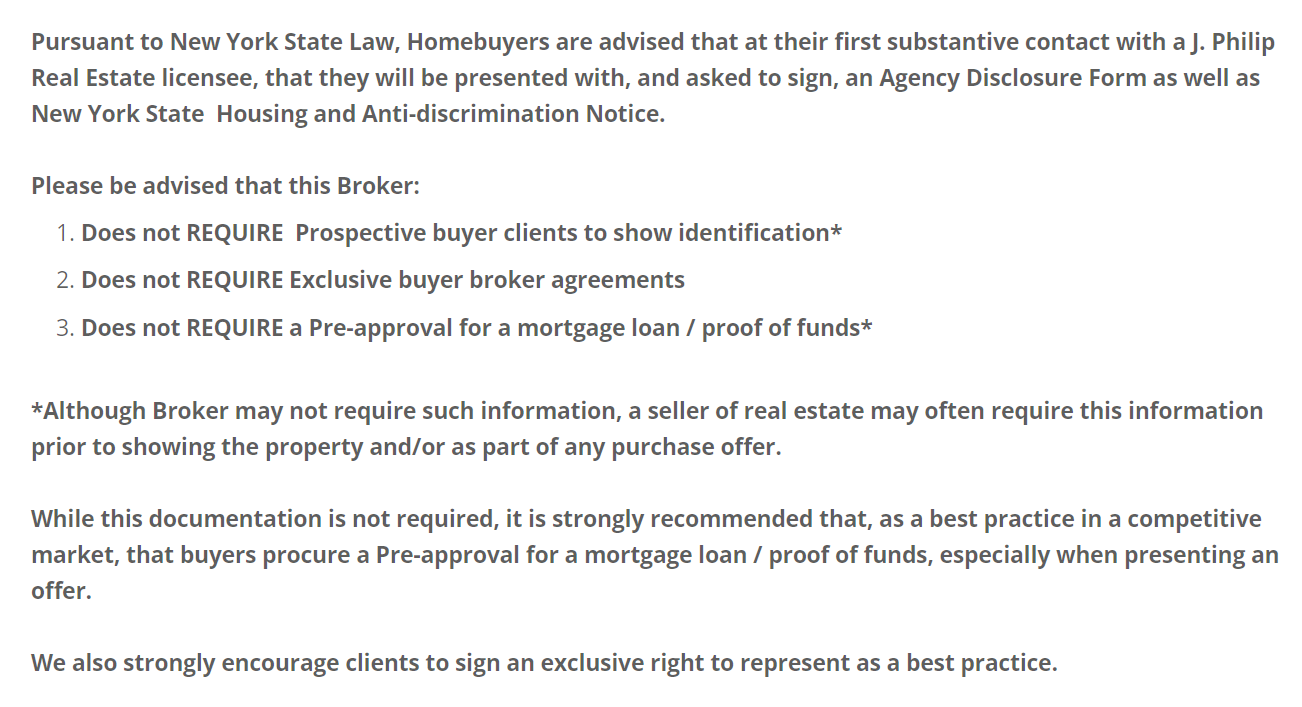

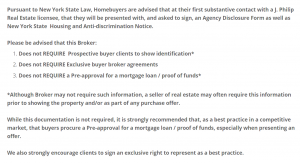

First, some background: In late 2019, Long Island Newsday published the shocking results of an investigation where reporters of different ethnicities and races went undercover as prospective homebuyers and the different ways they were treated by the real estate agents they engaged.

First, some background: In late 2019, Long Island Newsday published the shocking results of an investigation where reporters of different ethnicities and races went undercover as prospective homebuyers and the different ways they were treated by the real estate agents they engaged.

I don’t think I’ve seen the following thought written anywhere lately, but I’ll say it:

I don’t think I’ve seen the following thought written anywhere lately, but I’ll say it:

For Agents: Open House Parking Etiquette

One agent, unfortunately, only parked less than halfway in with their clients behind, and just one car fit behind them. I asked them to move up, and they demurred, promising to just be a “moment.” The “moment” was 20 minutes. I asked a second time, and was told they didn’t want to be blocked in. Well, yeah, waiting a few minutes for others to have their turn is better than blocking them out and not even giving them a chance to enter.

Some people parked down the street a bit where some temporary street parking was plausible. But one couple left, and that sucks.

We are all in this together. Selfish or tone deaf behavior when you are quite frankly a guest at someone’s home isn’t a good look, and it isn’t very collegial either. A minor inconvenience is part of the equation when the alternative is to alienate others. There are multiple offers on the house. It will sell. The seller will be happy. But I can’t get that couple out of my head who were so friendly who waited nearly 20 minutes, then decided to leave. I spoke with them. They should have bene able to enter. That’s not fair to them, and the results notwithstanding, my seller client would want them to have a chance also.