When I bought my home in 2007, its assessed value was $32,500. I paid about 20 times that amount, but that was how the municipality did assessments back then. Assessed values that do not reflect full market value can be extremely confusing for consumers. They also give real estate professionals a big headache, because it’s left to us to translate what could be a decades old number to modern day dollar amounts.

Thankfully, the majority of towns and cities in New York have their tax role assessed at full market value. However, there are still plenty of locales that don’t, and it’s not something that a lot of resources are devoted toward clarifying.

The reason some assessed values are so cartoonishly low is that they reflect the full market value of the property at a much earlier time period. Taxing authorities, then create their own unique conversion formulas to convert the assessments to current dollars but you have to contact the government office in order to procure that information.

To me, common sense would indicate that they simply program their computers to make the translation automatically and let that be that but apparently it is not that simple. My own town recently went to full market value assessments several years ago, and my understanding was that it was a large, expensive undertaking.

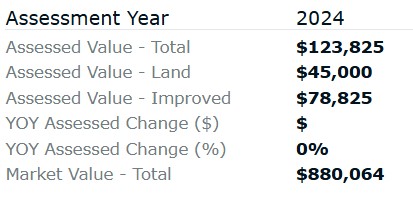

While I cannot unpack the administrative headaches of converting tax rolls to full market value, I can say to any consumer or licensee reading this that if you are looking at a home for sale with a list price of $950,000 but an assessed value of $175,000, you have to contact the assessor’s office to get the full market value figure. It’s a little extra work, but that goes a long way toward explaining the peculiar optic.

I don’t blame municipalities for not always having assessments current. Markets can change rapidly in a span of a few years, and I’ve seen values crater during the Great Recession and spike dramatically since the pandemic. “Government” and “agile” are seldom mentioned in the same sentence. At some point, however, years should not become decades. Some people have opined that failing to assess at full market value is a way of concealing over valuation and over taxation. I’m not a conspiracy theory guy, mainly because I don’t think that local governments are that coordinated. Regardless of motive or cause, however, when an assessed value seems untethered to actual market value, the agent needs to educate their client and get answers.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link